Some Ideas on Private Wealth Management Canada You Should Know

Some Ideas on Private Wealth Management Canada You Should Know

Blog Article

The Of Tax Planning Canada

Table of ContentsThe 6-Second Trick For Financial Advisor Victoria BcAn Unbiased View of Financial Advisor Victoria BcA Biased View of Investment RepresentativeThe Greatest Guide To Private Wealth Management CanadaTax Planning Canada Fundamentals ExplainedIndicators on Tax Planning Canada You Need To Know

Heath can be an advice-only coordinator, consequently he does not control their customers’ cash right, nor does he offer all of them specific financial loans. Heath states the appeal of this method to him usually he does not feel sure to supply a specific product to resolve a client’s cash problems. If an advisor is just geared up to offer an insurance-based way to an issue, they may become steering someone down an unproductive course during the name of hitting income quotas, he says.“Most financial services folks in Canada, because they’re paid according to the items they feature market, they may be able have reasons to suggest one strategy over the other,” according to him.“I’ve picked this course of activity because i will check my clients to them and never feel I’m using them at all or attempting to make a sales pitch.” Story continues below advertisement FCAC notes the manner in which you shell out the advisor is determined by this service membership they supply.

Retirement Planning Canada - An Overview

Heath with his ilk tend to be compensated on a fee-only model, consequently they’re paid like a lawyer might be on a session-by-session basis or a hourly consultation rate (independent financial advisor canada). With respect to the selection services and expertise or typical clientele of your own consultant or coordinator, per hour costs ranges from inside the hundreds or thousands, Heath states

This is often up to $250,000 and above, according to him, which boxes aside the majority of Canadian households out of this amount of service. Tale continues below ad for those of you incapable of pay fees for advice-based strategies, and also for those not willing to stop part regarding expense comes back or without enough money to begin with an advisor, there are cheaper and even free options available.

8 Easy Facts About Retirement Planning Canada Described

Story goes on below advertising discovering the right monetary coordinator is a little like dating, Heath says: You need to get a hold of somebody who’s reliable, provides an individuality match and is also best individual for phase of life you’re in (https://pblc.me/pub/125e92e301503b). Some favor their advisors to get more mature with much more knowledge, he states, while others like some one more youthful who is going to hopefully stick with them from very early years through retirement

Facts About Independent Investment Advisor Canada Revealed

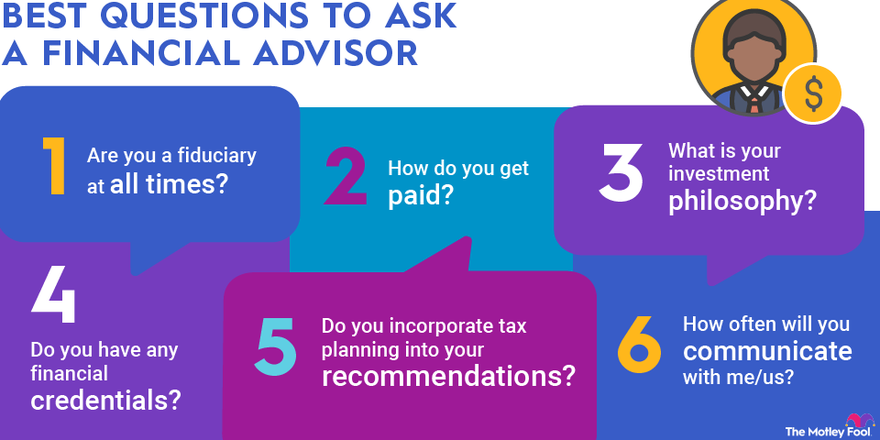

One of the greatest mistakes someone can make in choosing an advisor just isn't inquiring enough questions, Heath claims. He’s astonished as he hears from clients that they’re stressed about inquiring concerns and possibly appearing stupid a trend the guy discovers is equally as normal with set up specialists and the elderly.“I’m shocked, as it’s their funds and they’re spending a lot of charges to the individuals,” he says.“You deserve for your questions answered therefore deserve to own an open and sincere relationship.” 6:11 economic Planning for all Heath’s final guidance is applicable whether you’re selecting outside financial support or you’re heading it alone: become knowledgeable.

Here are four things to consider and ask your self whenever finding out whether you need to touch the expertise of a monetary expert. The internet worth is certainly not your income, but instead a sum which will help you comprehend what money you get, simply how much it will save you, and where you spend check here money, too.

Getting The Private Wealth Management Canada To Work

Your child is found on just how. Your divorce proceedings is pending. You’re nearing your retirement. These as well as other significant life occasions may encourage the necessity to see with a financial expert regarding your opportunities, your financial objectives, alongside financial issues. Let’s say the mother remaining you a tidy sum of cash in her own will.

You may have sketched your own financial strategy, but have trouble keeping it. An economic specialist can offer the responsibility that you need to put your monetary anticipate track. They even may advise how-to modify your own financial plan - https://www.bark.com/en/ca/company/lighthouse-wealth-management-a-division-of-ia-private-wealth/JvkL3/ being optimize the possibility effects

The Single Strategy To Use For Investment Representative

Anybody can state they’re a financial consultant, but an expert with expert designations is preferably the main one you ought to employ. In 2021, an estimated 330,300 People in america worked as personal financial experts, based on the U.S. Bureau of work studies (BLS). Many monetary experts tend to be self-employed, the agency claims - private wealth management canada. Usually, there are five forms of economic experts

Brokers generally make earnings on investments they generate. Agents tend to be regulated because of the U.S. Securities and Exchange Commission (SEC), the Investment business Regulatory Authority (FINRA) and condition securities regulators. A registered investment expert, either you or a strong, is much like a registered consultant. Both purchase and sell opportunities for their clients.

Report this page